How to Create Notion Budget Template? – A Complete Guide

Introduction

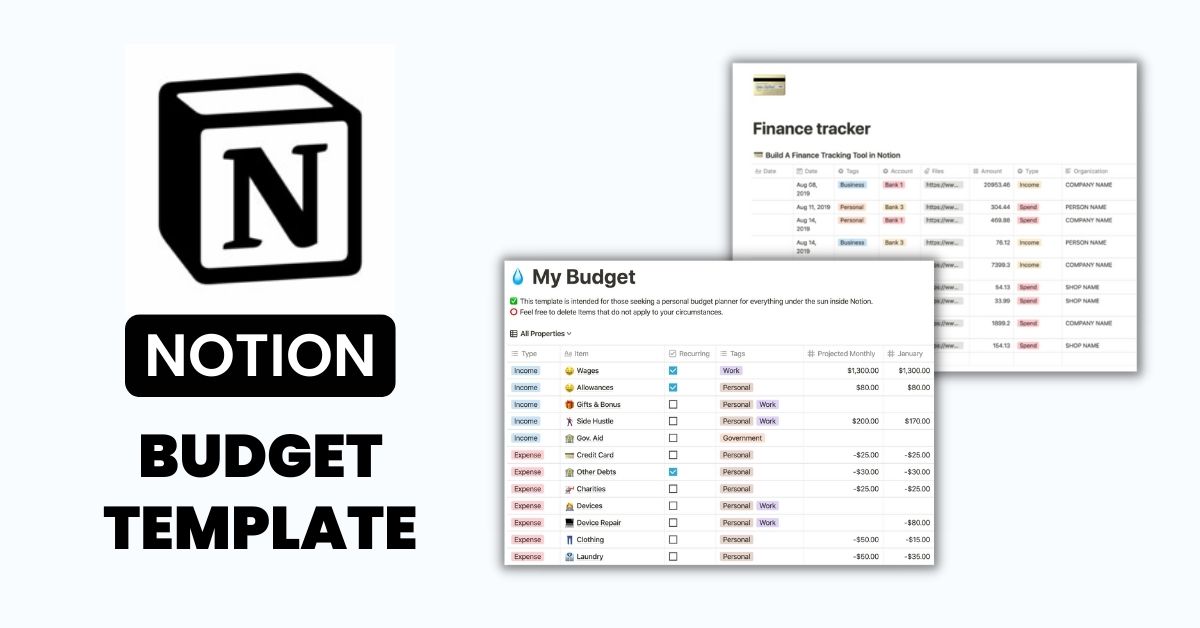

Tracking your expenses is key to managing your money wisely. Using a Notion budget template can make monitoring spending and balancing your finances much easier. In this post, we’ll walk through how to create a complete budget tracker template using Notion – the popular all-in-one productivity and collaboration tool.

A budget template allows you to categorize and record income and expenses in one centralized place. This gives you visibility into where your money comes from and where it’s going each month. Having these insights helps you make informed decisions to meet financial goals.

Notion provides a flexible workspace to build a customized budget template. With its drag-and-drop interface, you can add various components like tables, charts, calendars, and more. We’ll show you how to construct an automated budget tracker in Notion incorporating all the key elements you need.

Why Use Notion for a Budget Tracker?

Here are some of the main benefits of using Notion to create your budget template:

- All-in-one place – Track income, expenses, goals, and bank balances in one workspace.

- Flexibility – Easily add and arrange budget components however you like.

- Automation – Formulas auto-calculate and update balances.

- Collaboration – Share your budget with others to collaborate.

- Devices – Access your budget template anywhere from the mobile and desktop apps.

- Free tier available – Use basic Notion features for free.

Notion provides versatility to design a budget template tailored to your specific financial tracking needs.

Also Read: Best Voice Changing App for iPhone

Notion Budget Template Components

A comprehensive budget tracker template should include these elements:

Income Tracker

- List your income sources like salary, side business, interest, etc.

- Add estimated monthly amounts for each.

- Track actual amounts received using separate columns.

Expenses Tracker

- Categorize expenses like housing, food, utilities, transportation, etc.

- Add estimated amounts per category.

- Log actual amounts spent under each using separate columns.

Balance Summary

- Show overall monthly income amount based on income tracker totals.

- Display total monthly expenses pulled from the expense tracker.

- Auto-calculate monthly and yearly net balance based on income minus expenses.

Bank Balances

- Input your current balances for checking, savings, etc.

- Update periodically as balances change.

Budget vs. Actual Charts

- Create visual charts comparing budgeted vs actual income and expenses.

- Charts auto-update as you log transactions.

Calendar

- Display any scheduled income, transfers, or bills on a monthly calendar.

- Help forecast upcoming transactions.

Let’s now go through how to construct each of these sections in Notion.

Building the Notion Budget Template

From the Notion dashboard, create a new blank page for your Notion Budget Template. Using the + menu, we’ll add and configure all the components step-by-step:

Income Tracker

- Add a Table block for the income tracker.

- Add these columns:

- Income Source – Text input

- Monthly Estimate – Number Input

- Month 1 Actual – Number Input

- Month 2 Actual – Number Input

- Month 3 Actual – Number Input

- Name and format the table – for example, “Income Tracker” in Heading 2.

- Add rows for your income sources, like Salary, Side Business, Interest Income, etc.

- Input your monthly estimated amounts for each source.

Your income tracker table is ready! You can now log actual amounts received each month.

Expenses Tracker

- Add another Table block for tracking expenses.

- Add these columns:

- Category – Text input

- Monthly Estimate – Number

- Month 1 Actual – Number

- Month 2 Actual – Number

- Month 3 Actual – Number

- Name and format the table – for example, “Expenses Tracker” in Heading 2.

- Add rows for your fixed expense categories like Housing, Transportation, Food, etc.

- Input estimated monthly amounts per category.

Your expenses table is now ready to use for logging actual spending.

Balance Summary

- Add a blank Page block.

- Insert a Heading titled “Balance Summary”.

- Below it, add a Paragraph block.

- Type “Total Monthly Income: “

- Insert the Total formula:

Total(Income Tracker: Monthly Estimate)

- This will pull the sum of monthly income estimates from your income table.

- On the next line, type “Total Monthly Expenses: “

- Insert the Total formula:

Total(Expenses Tracker: Monthly Estimate)

- This will pull the total monthly expense estimates.

- On the next lines type:

“Monthly Net Balance: [Monthly Income – Monthly Expenses]Yearly Net Balance: [Monthly Net Balance x 12]”

- The auto-calculating formulas will populate your net monthly and yearly balances!

Your summary provides an overall picture of estimated balances.

Bank Balances

- Add a Table for tracking bank balances.

- Add these columns:

- Account

- Current Balance

- Last Updated

- Name it “Bank Balances” in Heading 2.

- Populate with rows like Checking, Savings, etc.

- Input your current balances and last update dates.

Now you can update your bank balances periodically.

Budget vs. Actual Charts

- Add a Header titled “Budget vs Actual”.

- Insert a Chart block.

- Configure as a Line chart comparing Month 1, Month 2, and Month 3.

- In the left axis, select “Expenses Tracker: Monthly Estimate” to show the budget.

- For the right axis, select “Expenses Tracker: Month 1 Actual” and so on to plot actuals.

- Duplicate this chart to also show income budget vs. actual.

Your charts will auto-populate and update as you log transactions!

Calendar

- Add a Calendar block.

- Name and Format it – for example “Upcoming Transactions” in Heading 3.

- Create events for scheduled income deposits, transfers, bill payments, etc.

The calendar allows you to visualize upcoming budget events in one place.

And that’s it – you now have a complete Notion budget template to manage your finances! The income, expenses, balances, charts, and calendar provide a centralized view of your budget and spending.

Tips for Managing Your Budget

Here are some tips for maintaining your new Notion budget template:

- Update income and expenses as transactions occur for accurate balances.

- Reconcile balances monthly when you receive bank statements.

- Review net balance each month to reallocate surplus or adjust expenses if required.

- Schedule a monthly recurring task on your calendar for budget review & updates.

- Set reminders leading up to major expenses and bill due dates.

- Check bank balances weekly and update them in your template.

- Meet with your financial advisor periodically to review the budget.

- Share access to the template with your partner to collaborate.

Staying disciplined about frequent updates ensures your Notion budget template has current information to guide smart money decisions!

Also Read: Best Digital Art Software for Beginners

Summary

As you can see, Notion provides a versatile platform for creating automated budget templates to organize your finances. The ability to customize income, expense, summary, chart, and calendar components gives you a comprehensive view of your money management strategy.

Implementing this budget tracker helps you align spending with your financial goals, spot problems, and make periodic adjustments. Plus it allows collaboration with others involved in your finances.

Hope this guide gives you a foundation for building your tailored money management template in Notion. Let us know if you have any other questions!